As the 30th of June is fast approaching it is time to starting considering your year-end planning options. Some important areas for consideration include:

• Deferral of Income – Delaying recognition of income until 1 July 2016, defers the tax liability on this income until the 2016 financial year. This strategy will be particularly effective for individuals who have significant capital gains to declare in the 2015 tax year and expect their taxable income to be significantly less next year. It is also effective for people who expect their income to drop in the 2016 financial year, possibly as a result of maternity leave or changing employment terms from full-time to part-time. The budget announcement regarding the reduced company tax rate and new tax offset for small businesses coming into effect results in a tax saving (in addition to the deferral) for small businesses who employ this strategy.

• Prepayments – Small businesses (turnover of less than $2 million) can claim prepaid expenses such as rent, lease payments and accounting fees.

• Splitting Investment Income – There may be advantages to having investment income (such as income from term deposits and investment accounts) earned in the name of the low-income spouse. If you have taxable income in excess of $180,000 and your spouse has no income, you could save $8,463 on $18,200 investment income if it is invested in your partner’s name.

• Superannuation – Superannuation is only a deduction when it has been received by the Superannuation Fund. Please ensure that superannuation contributions have been paid with sufficient time to be received by the Fund prior to 30 June.

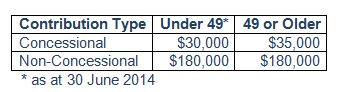

The concessional contribution cap for the 2015 financial year is $30,000 for everyone. Non-concessional contributions of up to $180,000 may also be made, as long as the bring-forward rule has not been utilised since 1 July 2012. These contributions caps also apply for the 2016 financial year.

• Bad Debts – Identifying and recognising outstanding debtors as unrecoverable prior to 30 June will result in a tax deduction being claimable for these amounts. However, you must have made a genuine attempt to collect the debt, which may include taking legal action.

• Depreciation – Your depreciation schedule should be reviewed annually and updated for any items that have been disposed of or have become obsolete.

Effective from 12 May 2015 to 30 June 2017, small businesses are allowed to claim an immediate deduction for depreciating assets costing less than $20,000, net of GST, to the extent that the asset is used for a tax-deductible purpose. The deduction for such purchases is allowed in the year the equipment is first available for use.

Beware that these provisions are only available to small businesses. To meet this requirement you must have an annual turnover of less than $2 million.

This presents small businesses with a great opportunity to get some additional tax deductions in the 2015 tax year by buying equipment costing less than $20,000 before 30 June 2015. A review if your existing fixed assets may identify items that may need replacement.

As always, careful consideration should be made to all purchases – Only buy assets you were intending on acquiring anyway.

• Trading Stock – Completing a review of stock on hand for items that are old, damaged or obsolete will allow you to scrap these items and write them off prior to 30 June. The amount written off will be immediately deductible.

• Employee Bonuses – Bonuses are deductible when incurred, so if you commit to paying a bonus prior to 30 June, it will be deductible in the 2015 financial year.

• Non Commercial Losses – Tax legislation prevents individuals from applying business losses against other income in certain circumstances. If you intend to claim business losses in 2015, please contact us to confirm that you meet the requirements to offset these losses against other income.

• Company and Trust Loans – Any money withdrawn by a shareholder or their associate from a private company could be deemed an unfranked dividend. These regulations can also apply to beneficiaries and associates of Trusts, particularly as a result of the ruling released by the Australian Taxation Office with regards to corporate beneficiaries and unpaid present entitlements.

If you would like any advice on the above please contact Grange Business Partners today – we’re here to help!