Contribution Options

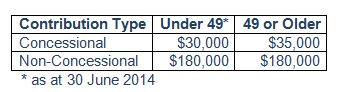

A reminder that the contribution caps for the 2015 financial year are as follows:

These contributions caps also apply for the 2016 financial year.

In making a decision to contribute to superannuation, high income earners should consider the impact of the additional tax applicable on concessional contributions. If your adjusted taxable income (which is calculated as your taxable income before allowing for losses from rental properties and financial investments) and concessional superannuation contributions exceed $300,000, you will be liable for an additional 15% tax on concessional contributions. This tax is assessed to you individually, but may be paid out of your superannuation benefits on assessment.

Members that were under 65 on 1 July 2014 are able to utilise the bring-forward rule to contribute up to $540,000 in non-concessional contributions, if this option has not been used since 1 July 2012.

Members over 65 must meet the work test in order to make superannuation contributions. This test requires 40 hours of work in a consecutive 30 day period. Once members reach this age they are ineligible to use the bring forward-rule.

Remember that superannuation contributions may be made in cash, or by making an in-specie contribution and transferring certain assets to the Fund. These assets include listed equities and business real property.